Founded in 2011, our core business is reinsurance, risk management and risk finance, working with facultative a treaty businesses in a wide range of insurance lines. We are acknowledged by the development of bespoke and pioneering projects involving the Traditional Risk Transfer (TRT) and Alternative Risk transfer (ART) market.

The promising reinsurance marketplace of Brazil was one of the last in the world to have promoted its opening to international markets and players, which occurred in 2007 after the privatization of IRB BRASIL RE. Nowadays, we have a more mature market, which generates billions in reinsurance and retrocession premiums and continues to show clear signs of new landscapes and opportunities for the future.

In this privatized scenario, where reinsurance allows to expand borders and build bridges that connect the whole world, BRIB Reinsurance is a broker with 100% national capital, figuring among the currently licensed 23 brokers and that continues to operate with the same expectation of growth and opportunities generated in the opening of 2007 for the reinsurance, risk management and transferring activities on the Brazilian market, in a wide range of insurance lines:

As members of the RIMS (Risk Management Association Society), BRIB Risk Management deals with the risk management of the Group’s customers and policyholders.

Strategic sector that Indicates the best alternatives and techniques for risk mitigation and transfer that involves:

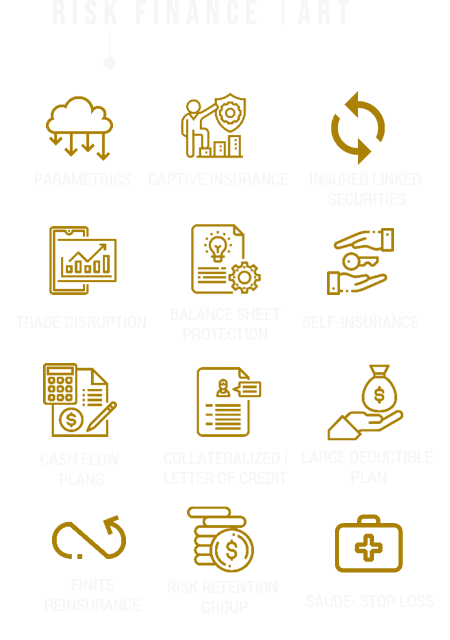

The convergence of the re/insurance and capital markets has changed the traditional thinking on the possible risk transferring mechanisms.

Risk Finance, therefore, refers to the new methods and instruments an organization selects to finance its recovery from accidental property and liability losses, addressing their needs with a new mindset toward risk mitigation, disruption and risk transferring, so as to achieve the best suited cost-efficiency for the treatment of their risk.

Maintaining our innovative and creative approach to cope with the marketplace new demands, we are members of the main alternative market associations of the world like VCIA and CICA, what enable us to offer and implement such new techniques and resources to our customers, among them:

Solid professional and experience background of almost 3 decades in the global re/insurance, risk management and risk transference market; RIMS professional member; Specialised in risk finance, being associated of VCIA – Vermont among other international associations and domiciles; Specialization courses of Reinsurance, Cargo, P&I, Hull among others at CII of London, as well as in several other lines such as Energy, Property, Engineering in renowned groups such as Munich re, Allianz, TELA Versiherung etc; Graduated in mechanical engineering at UFRJ; MBA from Unifacs-BA; Speaker, former professor of ENS (Brazilian National Insurance school) for several years.

Married to Marta, Father of Pedro and David.

Insurance broker (FUNENSEG) and Lawyer (Estácio-FIB University), specialised in bidding processes (Instituto RHS – São Paulo), postgraduate degree in Social Security Laws (Jus Podivm Institute in Salvador BA), Reinsurance training course by the London CII and member of AIDA Brasil, 12 years of performance and experience in the insurance and reinsurance market with specialisation in London and Munich.

Married to Monique, Father of Matias and Maria.